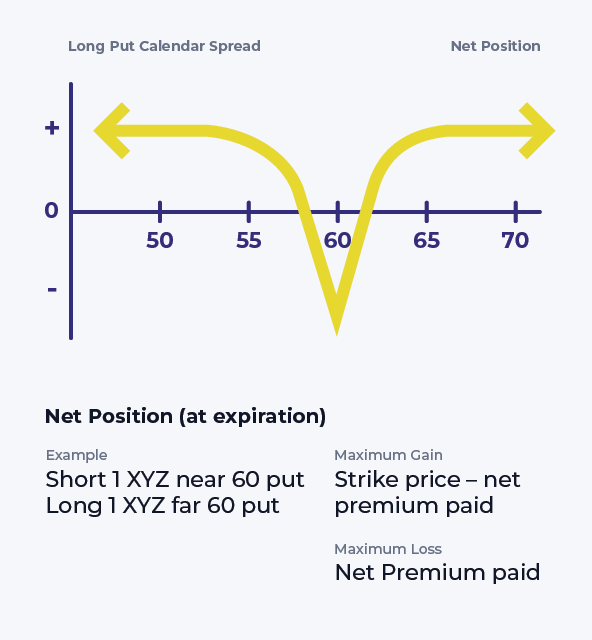

Long Put Calendar Spread

Long Put Calendar Spread - <<strong>calendar spread</strong> risk graph retrieved from ib’s trader workstation> a calendar. Web boeing calendar spread example. Web put calendar spreads primarily bear the risks of unexpected high volatility and significant movement of the underlying asset’s price away from the strike price. Web the long calendar spread with puts is also known by two other names, a “long time spread” and a “long horizontal spread.” “long” in the strategy name implies that the strategy is established for a net debit, or net cost. Let’s use the first line item as an example. Web when running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. Is the recovery rally over? They also profit from a rise in implied volatility and are. Web long put calendar a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at. Short 1 put at a shorter duration and the same strike. <<strong>calendar spread</strong> risk graph retrieved from ib’s trader workstation> a calendar. Web the long calendar spread with puts is also known by two other names, a “long time spread” and a “long horizontal spread.” “long” in the strategy name implies that the strategy is established for a net debit, or net cost. Web boeing calendar spread example. They also profit. Short 1 put at a shorter duration and the same strike. The terms “time” and “horizontal” describe the. Is the recovery rally over? Web boeing calendar spread example. Web introduction maximum loss maximum gain breakeven price payoff diagram risk of early assignment how volatility impacts the trade how theta impacts the. Calendar spreads allow traders to. Short 1 put at a shorter duration and the same strike. Web the long calendar spread with puts is also known by two other names, a “long time spread” and a “long horizontal spread.” “long” in the strategy name implies that the strategy is established for a net debit, or net cost. Web long put. Short 1 put at a shorter duration and the same strike. Web the long calendar spread with puts is also known by two other names, a “long time spread” and a “long horizontal spread.” “long” in the strategy name implies that the strategy is established for a net debit, or net cost. Web gordon scott what is a put calendar? Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. <calendar spread risk graph retrieved from ib’s trader workstation> a calendar. The terms “time” and “horizontal” describe the. They also profit from a rise in implied volatility and are. Is the recovery rally over? Web there are two types of long calendar spreads: This strategy profits from a decrease in price movement. Web long put calendar a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at. Let’s use the first line item as an example. Web boeing calendar spread example. Web put calendar spreads primarily bear the risks of unexpected high volatility and significant movement of the underlying asset’s price away from the strike price. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. On a weekly chart, sugar bounced convincingly off a support.![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Long Put Calendar Spread (Put Horizontal) Options Strategy

Long Calendar Spread with Puts Strategy With Example

Web When Running A Calendar Spread With Puts, You’re Selling And Buying A Put With The Same Strike Price, But The Put You Buy Will Have A Later Expiration Date Than The Put You Sell.

Long Calendar Spreads Are Great Strategies For.

With Boeing Stock Trading At $211.5, Setting Up A Calendar Spread At $215 Gives The.

Web Introduction Maximum Loss Maximum Gain Breakeven Price Payoff Diagram Risk Of Early Assignment How Volatility Impacts The Trade How Theta Impacts The.

Related Post: